Yes, you read that correctly. Dominion Energy, which reported over $3 billion in U.S. income, had an effective tax rate of -1%, meaning they actually made money while you were busy paying your fair share.

If you’re wondering how this is possible, it’s because companies like Dominion have manipulated the tax system to their advantage; an issue that was only exacerbated after the Republican-controlled U.S. Congress passed the 2017 Tax Cut and Jobs Act.

That bill, which slashed the corporate tax rate from 35% to 21% has caused the country’s deficit to skyrocket while also allowing many American corporations to zero out their federal income taxes.

According to a new report from the Institute on Taxation and Economic Policy (ITEP), a nonpartisan tax policy organization, Dominion is one of at least 60 publicly-traded companies that didn’t pay a dime in federal income tax for 2018. That is double the number of large companies that didn’t pay taxes prior to the new tax law taking effect.

When asked about the report by Virginia Business, Dominion spokesman Rayhan Daudani said that Dominion paid about $700 million in state and local taxes last year and placed $9 billion of capital investment into service. Daudani also says that the company is passing along savings by cutting customers’ rates to the tune of $180 million.

This news is likely to ruffle some feathers in the Commonwealth, especially considering Dominion is forcing customers to pay for the company’s clean up of its coal ash ponds and very nearly backed out of a deal on energy efficiency spending.

Dominion wasn’t the only Virginia company to avoid paying taxes; McLean-based Gannett reported $7 million in U.S. income, but received an $11 million tax rebate, meaning the company’s effective tax rate was -164%.

Meanwhile, Performance Food Group, based in Goochland County, used stock options to reduce its income tax by $20 million and received a tax rebate of $9 million on its $192 million in income, making for an effective tax rate of -4%.

Politics

Biden announces new action to address gun sale loopholes

The Biden administration on Thursday announced new action to crack down on the sale of firearms without background checks and prevent the illegal...

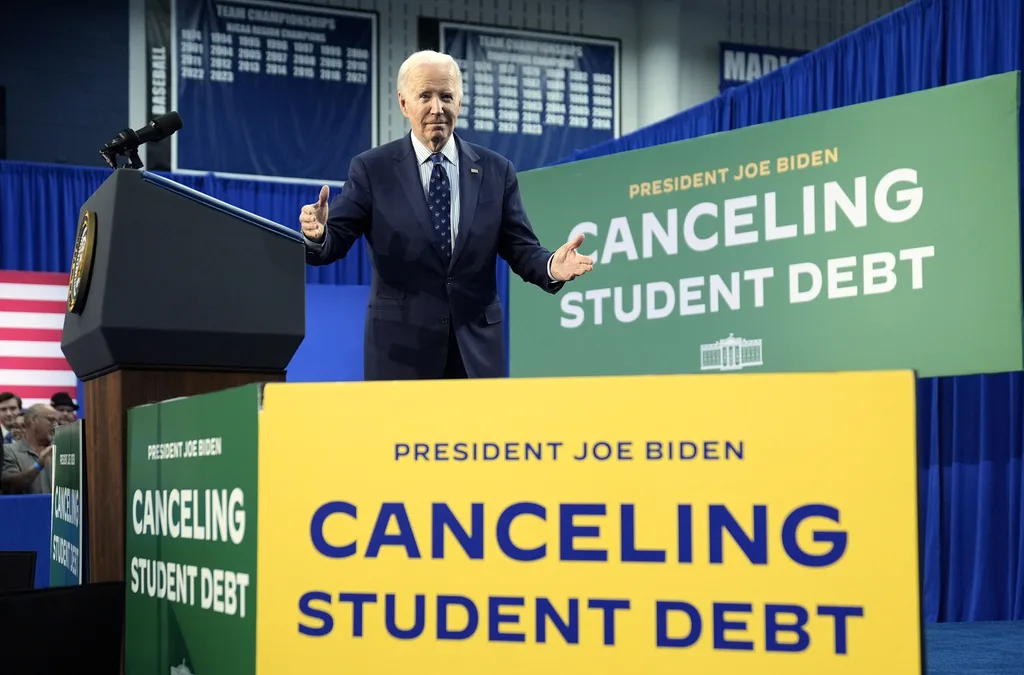

Biden cancels student loan debt for 6,130 more Virginians

The Biden administration on Friday announced its cancellation of an additional $7.4 billion in student debt for 277,000 borrowers, including 6,130...

Local News

Southside woman keeps the arts alive through community theatre

Katelyn Murray, a financial planner from the Danville area, grew up on stage. “I have been dancing since I was three, up through 23. I've been...

Virginia’s Homegrown Stars Had Big Moments in 2023

Although such celebrity meccas as New York and California may come to mind when you think of famous people, Virginia also has its fair share of...