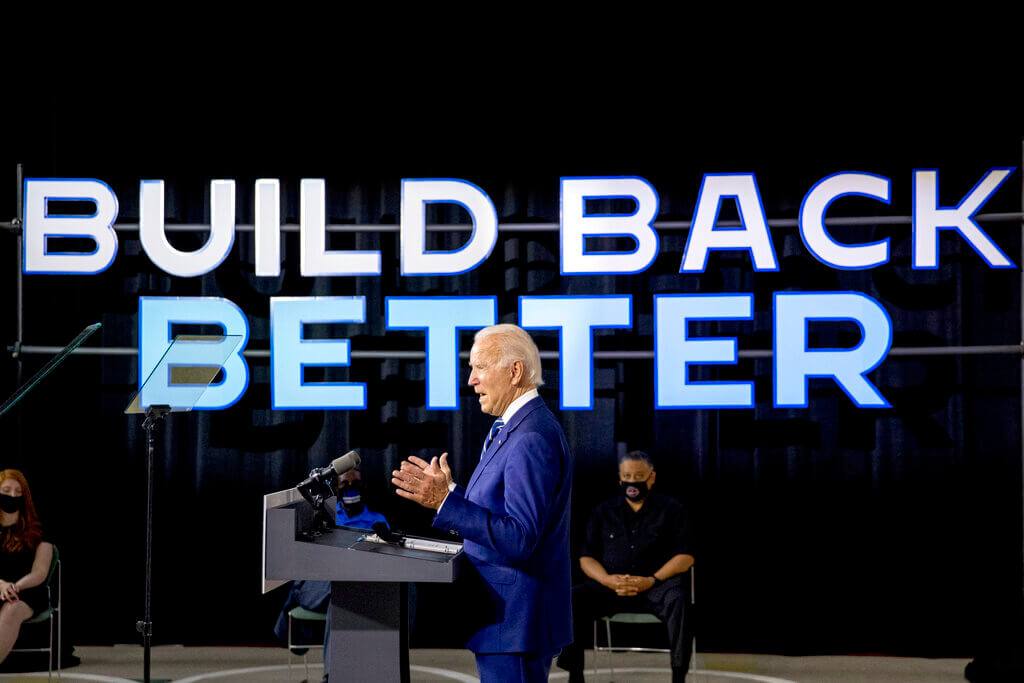

Democratic presidential candidate former Vice President Joe Biden speaks at a campaign event at the Colonial Early Education Program at the Colwyck Training Center, Tuesday, July 21, 2020 in New Castle, Del. (AP Photo/Andrew Harnik)

University’s analysis says more college students, working in higher paying jobs will cover the cost within a decade

WASHINGTON-Joe Biden’s Free College proposal pays for itself within a decade. That’s what professors from Georgetown University’s Center on Education and the Workforce say. Center officials released their analysis this past week, examining the plan and comparing it to multiple other free college proposals.

Biden’s version can be summed up in one sentence. If your family makes less than $125,000 a year, you’ll be able to go to any public college without paying tuition. The same goes for any community college. The government fully covers tuition and fees. Students just have to pay for housing, books and any transportation.

“Such a plan with no restrictions on student eligibility would cost $58.2 billion in the first year and $799.7 billion over an additional 10 years,” the center’s analysis said.

That’s where Biden’s plan is different. Since it only covers students with a yearly family income under $125,000, that drops the price a bit.

“In the first year, the plan would cost $49.6 billion, about $8.6 billion less than [one with no restrictions],” the center’s analysis said. “Over the ensuing 10 years, the Biden plan would cost $683.1 billion.”

While that’s still expensive, it’s time to see where it ranks in comparison to the other options.

Defining free college

When someone talks about going to college tuition-free, there’s three ways to make that happen. The first is through a debt-free program. In this version, the government picks up the entire tab. That means paying not just tuition and fees, but also covering housing costs and textbooks.

“This plan would be the most expensive, costing $75 billion in the first year,” the analysis stated.

Your second option is what’s called the “last dollar” program. First, you apply for Pell Grant awards or any other available federal financial aid. Once you receive the grant and that money is spent, then the government steps in to cover the remaining cost of tuition. That means instead of using the grant money for housing and textbooks, you have to pay for those things another way. Understandably, this is the cheapest option.

“This plan would cost $27.8 billion in the first year and $414.9 billion over an additional decade,” Georgetown’s report said.

And then there’s the version Biden adopted, called the “first dollar” program. This one is just like it sounds. Government pays first, covering all tuition and fees. Then any financial aid you received goes to textbooks and housing. As we mentioned above, without restrictions, that adds up to $58.2 billion in the first year and $799.7 billion over the next decade. With Biden’s version that only includes families making under $125,000, it adds up to $49.6 billion in the first year and $683.1 billion over the decade.

So if a “first dollar” program is the middle option when it comes to cost, why did Georgetown say it would be a benefit? The answer, the report says, is in how the money is spent.

Cost vs. assistance

In 2008, it cost $16,460 annually to attend a public college in Virginia. Jump ahead a decade to 2018 and that number climbed to $21,000. In fact, it’s constantly been rising over the last 40 years. On the one hand, the College Board says it’s not increasing as fast as it used to.

“Between 2009-10 and 2019-20, published in-state tuition and fees at public four-year institutions increased at an average rate of 2.2% per year beyond inflation, compared with 3.9% between 1989-90 and 1999-00 and 5.0% between 1999-00 and 2009-10,” the College Board said in its annual report.

But that still leaves a problem, as Georgetown’s analysis points out.

“Despite higher education’s obvious benefits, many students avoid or quit college because they simply cannot afford it,” the study says. “Tuition and fees at public four-year colleges have grown 19 times faster than the median family income since 1980 as funding for college has waned at both the state and federal levels, shifting much of the financial burden to students.”

This is why a last dollar approach to free college doesn’t work, the analysis argues. Students that come from low-income families can’t afford to handle living expenses on their own without some help, at least until they get a job. If financial aid is used for tuition rather than housing, that limits their options and opportunities.

That’s why a first-dollar program like Biden’s makes more sense, the analysis states.

“Last-dollar programs are less expensive because they force students to use their financial aid before the government pays the remaining tuition cost,” the study says. “The Biden plan, a first-dollar free-college program with an income cap, is more equitable in terms of race and class coverage than other major plans.”

But how do you pay for it?

The big question with any new plan is always about money. How do you pay for it? The answer, Georgetown officials said, comes as a result of the plan itself. If Biden’s plan gets put into action, that means more students go to college. As a result, they’re able to get better paying jobs and inject more tax revenue into the system.

“This estimate assumes that more students would earn college credentials and get jobs that lead to an additional $371.4 billion in federal and state tax revenue and private after-tax earnings gains of $866.7 billion,” the study says. “These benefits would outweigh the costs of tuition-free-college programs, with yearly tax revenue exceeding the annual cost within the first 10 years after a tuition free program is implemented.”

Politics

Biden administration bans noncompete clauses for workers

The Federal Trade Commission (FTC) voted on Tuesday to ban noncompete agreements—those pesky clauses that employers often force their workers to...

Democratic shakeup in Virginia primaries for governor, lieutenant governor

Richmond Mayor Levar Stoney quit his bid for governor and jumped into the race to be the Democratic nominee for lieutenant governor. The race for...

Local News

The zodiac signs of 12 iconic women offer insight into their historic accomplishments

Zodiac signs can tell you a lot about someone’s personality. Whether they’re an earth, water, air, or fire sign, these 12 categories (which are...

Virginia verses: Celebrating 5 poetic icons for National Poetry Month

There’s no shortage of great writers when it comes to our commonwealth. From the haunting verses of Edgar Allan Poe, who found solace in Richmond's...