General Assembly committee hears what local cities and counties need to recover from COVID-19.

RICHMOND – While the financial impact of the COVID-19 pandemic varies wildly from place to place, localities representing every region of Virginia are all asking the General Assembly for the same thing – funding for education and emergency services.

In a panel discussion at the Joint Subcommittee on Local Government Fiscal Stress meeting Monday, local government leaders and staff members presented committee members with a multidimensional picture of how the pandemic has affected their unique communities. Representatives of Henrico County, Fairfax County, York County, and Pennsylvania County made presentations to the board.

While the impact of the pandemic varied from locality to locality, their biggest expenditures are the same.

“There’s a hundred different problems that you could fix. But we all understand that the two biggest things we spend money on are public education and public safety. Whatever you can do to support us in those two areas makes all of our other challenges much more manageable,” said Neal Morgan, county administrator for York County.

They’ll get their wish when it comes to education.

New COVID-19 Funding Will Prioritize Education

Virginia will receive an estimated $2.7 billion in the latest federal COVID-relief funds, according to Kimberly McKay, legislative fiscal analyst for the Virginia House Appropriations Committee. The majority of that money, $963 million, will go towards an education stabilization fund for the Commonwealth.

“These can go to flexible uses like Title One expenses, PPE, technology for remote learning, and HVAC improvements. The key that we found out so far with these funds is that about 90 percent will go directly towards school divisions. So about$ 840 million dollars. Which is three times the amount school divisions received through the Elementary Secondary School Emergency Relief Fund in the CARES Act,” Kimberly McKay said.

The Commonwealth spent the majority, or 30%, of its previous relief funds on costs associated with public health and safety. Those funds are a game changer for some communities without the resources to update their healthcare facilities on their own.

“We advanced programs that in our wildest imagination we wouldn’t otherwise have been able to do. A good example of that is the purchase of quick response vehicles,” said David Smitherman, county administrator for Pittsylvania County. “We have almost twenty, almost two dozen fire and rescue agencies in our community that were not well-prepared to respond to this pandemic. Whether it be PPE, the ambulances, supplies, with trucks, we have largely [prioritized] the public safety of our community using the CRF funds and we’re very proud of that.”

Public Safety Takes a Holistic Approach to Health

What qualifies as supporting public safety is also up for interpretation. Due to the vague language of the CARES funding guidelines, Virginia localities are able to spend that money with a more comprehensive view of health in mind.

“The cost and the breath of what we consider public safety is expanding. I think generations ago, or even a couple decades ago, public safety was black and white, Administration of the law, arrest, and prosecute. And what we’ve found is that creating an environment that is safe and sustainable and can build the community is much more than that. So public safety now encompasses social services. And it encompasses mental health. And it encompasses taking care to those who can’t care for themselves,” said Meghan Coates, director of finance for Henrico County.

Virginia is not prioritizing funding for public safety during the latest round of federal relief, however. Instead, it plans to commit $608 million to the cost of testing and vaccine distribution, according to Kimberly McKay.

$568 million of the remaining funds will go to rental assistance programs.

Left Over COVID-19 Relief Funding

The Commonwealth has already received $3.1 billion in federal COVID-19 relief funds since the COVID-19 pandemic began last March. The state government retained $1.8 billion for investments in statewide programs, while localities received 1.3 billion to support their communities. The population size of localities determined how much money they would receive.

“The pandemic has put an unprecedented strain on local governments. And the need for our local communities have grown substantially in this last year. Federal resources, especially the CARES Act, have been vital in aiding localities with the cost of our pandemic response,” said Jeff McKay, chair of the Fairfax County Board of Supervisors.

Despite a previous December 31, 2020 deadline to use these funds, in September of that year Virginia only spent 37.4% of its local Coronavirus, Aid, Relief, and Economic Security (CARES) Act money. That’s over $800 million in unused federal funds. Or it would have been, if the new COVID-19 relief bill did not also extend the deadline to the end of 2021.

In September, according to Kimberly McKay, only Henrico County and the City of Manchester spent the entirety of their funds. Lee County had only spent 0.1% of their available relief funding by the end of that month. At the time, the average county in Virginia allocated 68.8% of its relief funds.

RELATED: Time’s Running Out: Southwest Virginia Cities, Counties Need CARES Act Extension

Cutting Local Costs While Spending Federal Dollars

Funding through the CARES Act can only go towards costs associated with responding to the pandemic. However, confusion about what qualifies as direct costs remain. Its one factor local government representatives say causes localities to not use their funding in time.

“We had a very intentional approach to the CARES Act funding. Because the guidance was so unclear and because it was ever-changing. What we did was take the most broadly applicable guideline that we could to help meet our expenditures,” Coates said.

According to Coates, Henrico County took drastic action to protect its financial future as soon as the COVID-19 pandemic hit. She says they were right to be cautious.

“We cut a hundred million dollars from the fiscal ’21 budget as our reaction to the coronavirus. Our approach was to find a floor. We wanted to be as aggressive as we possibly could be. So that should the virus persist, as it has, that our budget would be low enough that we could sustain it for the duration of the fiscal year. And not have to come back and make additional cuts,” said Coates.

Property Revenue Increases Temporary

According to experts, property tax revenue is generally up in the Commonwealth.

“We have been experiencing a strong real estate market. Probably one of the stronger ones that we’ve seen in a decade, if not two, even back to the late ’90s. Things have really picked up, building permits are up,” said David Smithermand, county administrator for Pittsylvania County.

However, that’s expected to change soon. According to Rosabelli, business closures and the shift towards working at home will slow property sales.

“We have hundreds of thousands of square feet of vacant retail space. And the problems with bricks and mortar retail have only accelerated during the pandemic. So what that means in the longer term is unclear,” said Morgan.

From Northern Virginia, Jeff McKay said his locality is estimating no change to its revenues next year.

“We estimate a shortfall of over forty million dollars in Fairfax County, with expected revenues projected to be flat, with zero growth expected in combined real estate and property taxes. Probably for the foreseeable future,” said Jeff McKay.

Tourism Revenue Down Due to COVID-19

For localities which rely on tourism to fill out their coffers, the pandemic is gutting their budgets.

“Localities that are highly dependent on tourism revenue are suffering a little bit more than some of the others. And for us, even though they’re not gigantic revenue sources in terms of percentages, lodging taxes have been absolutely devastated,” Morgan said.

For a small coastal community like York, the loss of tourism revenue impacts every aspect of its budget.

“At some points during the fiscal year [tourism revenue was] down by as much as 80 percent, meals tax more in the 30 – 40 percent range,” Morgan said.

The same social distancing guidelines which discourage Virginians from traveling for leisure also discourage nonessential group activities. That’s why Morgan thinks user fee revenues are also down in York County.

“A lot of small user fees, for example people going to court and people signing up for Parks and Rec. programs, we’re really getting hurt on those small types of user fees. Because a lot of those things are just not occurring as they normally did,” said Morgan.

Sales Revenue Increasing

While tourism, small fee, and property revenue will decrease long-term, the same is not true for sales revenue. Though it dipped significantly in the beginning of the pandemic, sales tax revenue is up across Virginia.

Particularly in the Southwest, sales tax revenues are now returning to normal levels.

“It’s very volatile until February of 2020. And then we have a 30 percent drop over a 60 day period. And then a full recovery where we have stayed without hardly any fluctuation for the remainder of the pandemic to date,” Smitherman said. “That is the most stable it has been in recent history. And has been the reason that we feel fairly good fiscally right now.”

According to Smitherman, that’s in large part due to recent changes to Virginia’s tax code related to internet sales.

“Our savior has been the sales tax,” said Smitherman. “The lawsuits to solve the internet sales tax point of delivery scheme of distributing revenue has been a godsend to us.”

Smiterman is referring to the 2018 U.S. Supreme Court Case South Dakota v. Wayfair, Inc. As a result of this case, Virginia can now require online shoppers to pay sales taxes to the Commonwealth.

Representatives of local governments across Virginia agreed that this decision helped keep their operations afloat.

“I’ll just say, thank God for the decision that allowed internet sales tax to be collected and distributed because those trends obviously accelerated very rapidly over the past year. And I think many of us would have been hurt much more seriously had that not occurred,” Morgan said.

Diversifying Revenue Sources Due to COVID-19

Most localities rely on real estate and property taxes for the majority of their funding, according to Kimberly McKay. She estimates that 45.1% of revenue in cities and 54.8% in counties are from real estate and property taxes.

Due to the projected declines in both those revenue sources, the General Assembly made reforms to its Tax Code in 2020. These reforms expand the rights of counties to tax their residents.

For example, House Bill 785 grants counties the same taxing powers cities and towns currently have. Under prior law, when compared to cities and towns, counties had less authorization to implement taxes, according to the Virginia Department of Taxation’s 2020 Legislative Summary.

Under the same legislation, localities can now levy a food or and beverage tax at a rate of less than six percent.

For a handful of counties in Virginia including Pittsylvania County, new laws permit them to levy additional sales and use taxes by up to one percent. The revenue localities gain from these tax increases must go to support the construction or improvement of schools.

“Throughout the Commonwealth, individuals are talking about the limited resources they have, whether it’s being produced by counties or cities, to build schools. And many of these schools have ages 50, 60, 70 years on them. And I think it has to become a priority,” said Sen. Delores McQuinn (D – Richmond).

Meg Schiffres is Dogwood’s associate editor. You can reach her at [email protected].

Politics

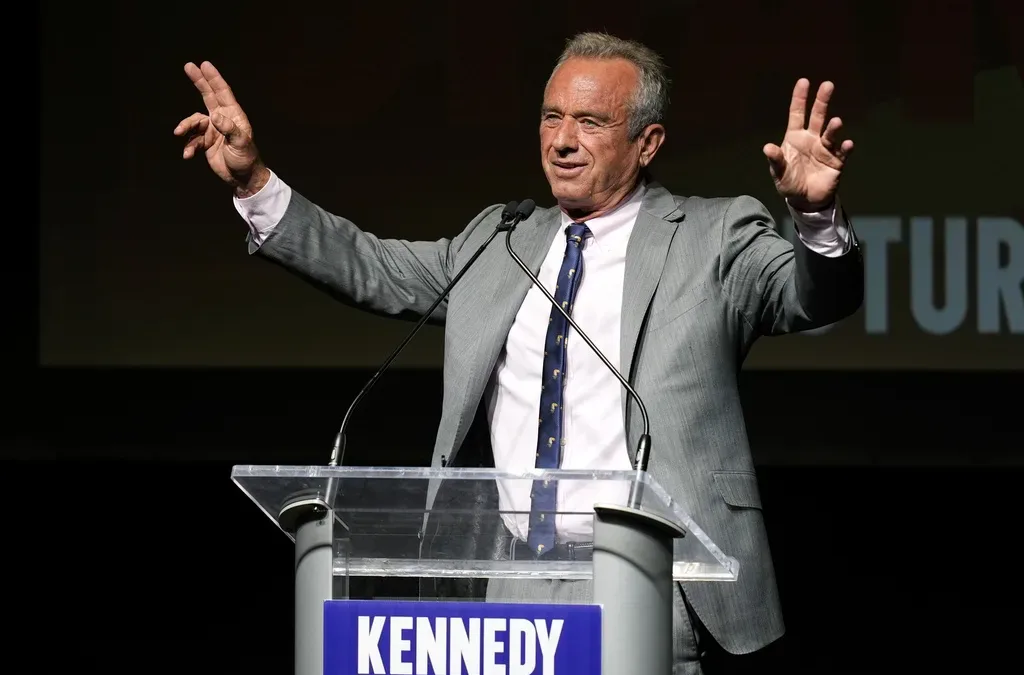

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

Opinion: The problem with Youngkin’s Charter-Lab schools push in 2024

The Problem Governor Glenn Youngkin introduced 233 amendments to the bipartisan budget so it was hard to know how to assess his budget–for example,...

Local News

Virginia verses: Celebrating 5 poetic icons for National Poetry Month

There’s no shortage of great writers when it comes to our commonwealth. From the haunting verses of Edgar Allan Poe, who found solace in Richmond's...

Join the fun: Recapping Family Literacy Night’s storybook adventures

When’s the last time you read a book aloud with a loved one? If it’s difficult to answer that question, then maybe it’s time to dust off that TBR...