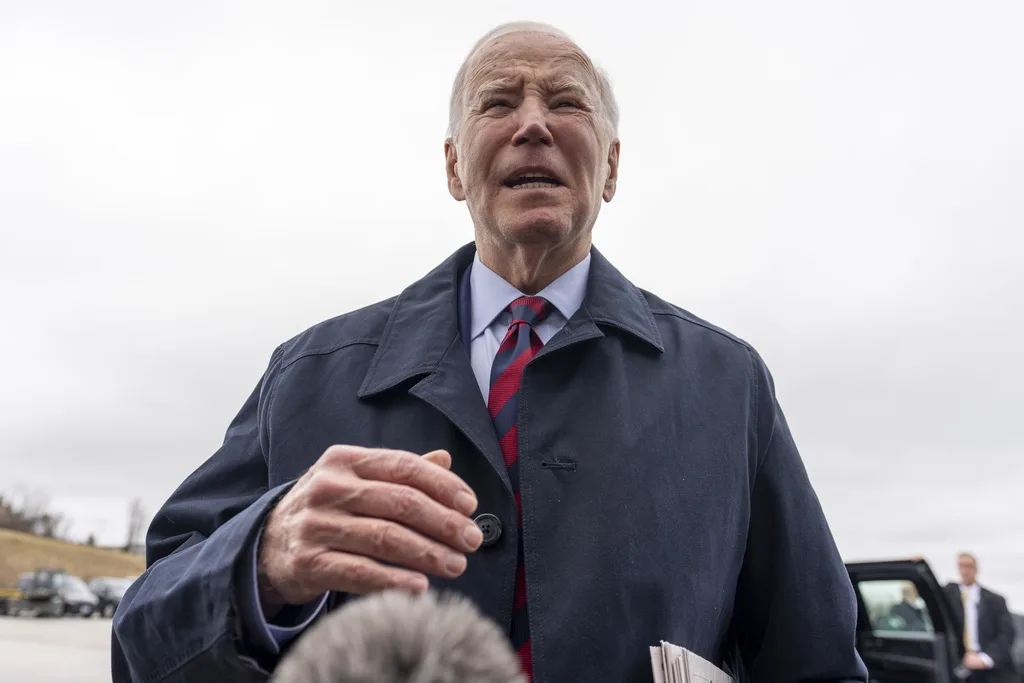

President Joe Biden delivers remarks on lowering prices for American families during an event at the YMCA Allard Center, Monday, March 11, 2024, in Goffstown, N.H. (AP Photo/Evan Vucci)

The president’s budget includes proposals to lower childcare costs, create a paid family leave program, lower drug costs, and strengthen Social Security and Medicare—all by raising taxes on the wealthy and corporations.

President Joe Biden on Monday unveiled his budget for the 2025 fiscal year, a plan that proposes numerous policies to lower costs and provide support for everyday Americans while raising taxes on the country’s wealthiest corporations and shrinking the federal deficit.

Biden’s budget announcement came just days after last week’s State of the Union speech and ahead of a reelection campaign where the economy will play a central role.

Despite a robust economic recovery from the pandemic, buoyed by low unemployment rates of under 4% and the creation of nearly 15 million new jobs since he took office, Biden’s approval rating remains low on economic issues.

Reducing costs for families is at the heart of the budget, which outlines proposals for expanding and cementing tax credits—including the Earned Income Tax Credit and the Low-Income Housing Tax Credit, the latter of which incentivizes production of low-income housing and expands options for renters facing financial challenges.

Biden’s budget also outlines a plan to expand the Child Tax Credit, which gives parents a tax break for qualifying children. Proposed changes in the budget would increase the amount of money back parents would receive and make benefits available to families in monthly installments throughout the year instead of providing a lump sum. The proposal would effectively restore the more generous credit that families received in 2021, thanks to the American Rescue Plan.

The budget also includes a national paid family and medical leave program that would provide up to 12 weeks of leave for eligible workers following the birth or adoption of a child—even for parents whose jobs don’t currently qualify them under the Family and Medical Leave Act (FMLA).

Biden’s budget further calls for a new program that would guarantee access to reliable, low-cost child care services from birth until kindergarten to families making less than $200,000 per year. Under the plan, most working families would pay $10 or less per day, while the lowest income families would receive free care.

The president also proposed raising taxes on giant corporations and billionaires, which would help fund the programs proposed under the budget.

These efforts would include implementing a Billionaire Minimum Tax of 25% on America’s wealthiest individuals, solidifying a 21% minimum corporate tax rate, and increasing the tax on stock buybacks from 1% to 4%.

“The investments in the President’s budget are fully paid for, and the budget would reduce deficits by approximately $3 trillion through a combination of smart savings and tax proposals that ensure wealthy individuals and large corporations pay their fair share,” Secretary of the Treasury Janet L. Yellen said in a press release.

Biden’s proposal does not include any tax increases on Americans earning under $400,000 per year.

Healthcare is also central to the president’s 2025 budget proposal, with Biden calling for expansion of the Inflation Reduction Act to keep out-of-pocket costs low for prescription drugs. His budget proposes capping insulin costs at $35 per month for all Americans, not just seniors on Medicare.

The budget would close Medicare tax loopholes for wealthy Americans, ensuring that individuals making $400,000 or above annually would pay their fair portion toward keeping seniors covered under Medicare. Biden takes a similar stance on Social Security; his budget would require wealthy taxpayers to make greater contributions to the program and strengthen the Social Security Administration with a $1.3 billion budget increase.

Together, the White House says these proposals would help stabilize and strengthen Social Security and Medicare, ensuring they avoid any budget cuts or funding shortfalls.

Amid turmoil in the reproductive health sector, Biden also proposes doubling funding for women’s health research at the National Institutes of Health.

A 36% funding increase for the Title X Family Planning program is also included in the budget, a move that would benefit “maternal healthcare, contraception, and family planning services, which are essential to ensuring control over personal decisions about their own health, lives, and families,” according to a statement from the White House.

The 2025 Biden budget is simply a proposal meant to offer insight into the President’s priorities for the coming year. It also provides a blueprint for second term aspirations as Biden readies to campaign against presumptive Republican opponent Donald Trump.

Politics

Biden administration bans noncompete clauses for workers

The Federal Trade Commission (FTC) voted on Tuesday to ban noncompete agreements—those pesky clauses that employers often force their workers to...

Democratic shakeup in Virginia primaries for governor, lieutenant governor

Richmond Mayor Levar Stoney quit his bid for governor and jumped into the race to be the Democratic nominee for lieutenant governor. The race for...

Local News

The zodiac signs of 12 iconic women offer insight into their historic accomplishments

Zodiac signs can tell you a lot about someone’s personality. Whether they’re an earth, water, air, or fire sign, these 12 categories (which are...

Virginia verses: Celebrating 5 poetic icons for National Poetry Month

There’s no shortage of great writers when it comes to our commonwealth. From the haunting verses of Edgar Allan Poe, who found solace in Richmond's...