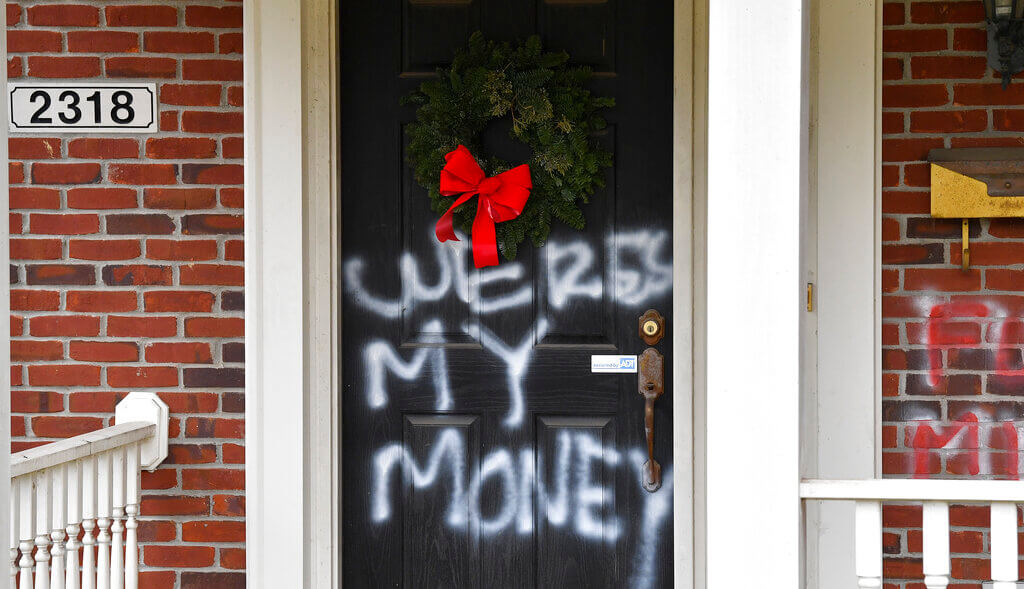

Graffiti reading, "Where's my money" is seen on a door of the home of Senate Majority Leader Mitch McConnell, R-Ky., in Louisville, Ky., on Saturday, Jan. 2, 2021. As of Saturday morning, messages like “where’s my money” and other expletives were written with spray paint across the front door and bricks of the Kentucky Republican’s Highlands residence. (AP Photo/Timothy D. Easley)

The IRS sent millions of much-anticipated stimulus relief checks to closed accounts with no known plan to remedy the glitch and get funds to taxpayers soon.

After enduring almost eight months of congressional bickering over a new economic relief package, millions of Americans might still have to wait weeks before receiving their second stimulus check.

On Dec. 29, the IRS started issuing the second round of stimulus checks after approving the latest round of COVID-19 relief approved on Dec. 22. So far, the Treasury Department has paid out about 68% of the stimulus payments through direct deposit or a check in the mail. But some Americans who used tax filing companies like TurboTax, Jackson Hewitt, or H&R Block could have their payments delayed. According to NBC News, about 14 million people, many of whom are low-income earners, are likely to be affected.

A glitch the IRS has been aware of is behind the delay. Online tax filing systems or tax preparers take their service fee directly out of the tax refund before routing the refund to the taxpayer. The tax preparation companies typically use temporary accounts to receive the taxpayer’s refund from the IRS. The IRS attempted to deliver stimulus checks to these same accounts, which are now closed. This means that some checks were being routed to tax filing systems instead of individuals and were returned to the IRS as a result.

In the first round of stimulus payments, if a payment bounced back with an error, like the one popping up for tax filers, the IRS tried to issue a check or debit card payment in the mail. However, this time, due to a self-imposed check distribution deadline of Jan. 15, the IRS and the Treasury Department aren’t expecting to remedy this issue in time.

So far, the IRS is only offering one solution that many Americans are unhappy about.

“The IRS advises people that if they don’t receive their Economic Impact Payment, they should file their 2020 tax return electronically and claim the Recovery Rebate Credit on their tax return to get their payment and any refund as quickly as possible,” the IRS said in a statement posted to the department’s website.

According to data released on Monday, the Treasury has paid Americans $112.3 billion in the second round of COVID-19 relief payments. Although the government is getting stimulus payments out to Americans faster than the first round last spring, agencies are facing mounting public criticism for not fixing problems in the many months since.

For now, the IRS is encouraging people to use its Get My Payment Tool on the department website to check their payment status. In a statement released Tuesday, the IRS noted that if a taxpayer uses the tool and a message appears that says “Payment Status #2– Not Available,” the person will not receive a payment via direct deposit or a check in the mail.

“It is disappointing that the IRS did not fix this problem, in light of the likelihood of a new round of stimulus payments,” said Lauren Saunders, associate director of the National Consumer Law Center on Twitter. “People who need money now may have to wait months until they can file a tax return and get their refund.”

President-elect Joe Biden has shown interest in sending Americans additional stimulus payments upwards of $2,000. With control of the House, Senate, and the White House, additional economic relief is likely. But the current delays raise concerns that funding could take a while to reach Americans that need it most, especially at the beginning of tax filing season.

VIDEO: Your support matters!

Your support matters! Donate today. @vadogwoodnews Your support matters! Visit our link in bio to donate today. #virginianews #virginia #community...

Op-Ed: Virginia’s new Democratic majorities pass key bills to improve your lives, but will Youngkin sign them?

The 2024 Virginia General Assembly regular session has wrapped up. It was a peculiar session from the outset, with Democratic majorities in the...

Op-Ed: Why Virginia Needs A Constitutional Amendment Protecting Reproductive Freedom

Virginia’s recent election season in 2023 drew in eyes from all over the country. Reproductive freedom was on the line and Virginia remained the...

From the state rock to the state flower, here’s how Virginia got its symbols

Have you ever wondered why the Dogwood is the state flower? Or how the cardinal became the state bird? We’re here to answer those questions and more...

VIDEO: Second-gentleman Douglas Emhoff gives speech on reproductive freedom

Second gentleman, Douglas Emhoff touched on reproductive freedom not only being a woman's issue but "an everyone's issue" during the Biden-Harris...

Glenn Youngkin and the terrible, horrible, no good, very bad night

Election Day 2023 has come and gone, and while there are votes to be counted, one thing is perfectly clear: Virginians unequivocally rejected Gov....