Kamala Harris has proposed increasing the corporate tax rate, expanding the child tax credit, and cutting taxes for more than 100 million working and middle class Americans. Donald Trump, meanwhile, said he wants to permanently extend tax breaks that primarily benefited the ultra-wealthy and corporations. (Graphic by Francesca Daly)

Kamala Harris has proposed increasing the corporate tax rate, expanding the child tax credit, and cutting taxes for more than 100 million working and middle class Americans. Donald Trump, meanwhile, said he wants to permanently extend tax breaks that primarily benefited the ultra-wealthy and corporations.

As Election Day draws closer, voters overwhelmingly continue to make clear that the most important issue for them in this year’s presidential election is the economy and their sense of financial security.

And this year, the economic plans proposed by the two presidential candidates — Democrat Kamala Harris and Republican Donald Trump — could not be more different, especially when it comes to the topic of taxes.

Harris supports a billionaire minimum income tax to ensure that the wealthiest Americans and companies pay their fair share and wants to increase the corporate tax rate from 21% to 28%. The corporate tax rate is currently at its lowest rate in nearly a century, after Trump delivered a massive tax cut to big corporations with his 2017 tax law, which effectively slashed their tax rate from 35% to 21%.

She also wants to quadruple the tax on stock buybacks — this is when a company buys back its own stock instead of investing in workers or research or equipment. Stock buybacks reduce the total number of shares available, effectively raising the prices of other shares, and often boosting top executives’ compensation, which is usually tied to the performance of their company’s stock (i.e. a higher stock price makes them personally wealthier).

The vice president has additionally vowed to “cut taxes for more than 100 million working and middle class Americans,” if elected. Harris has repeatedly emphasized that no one earning less than $400,000 per year would pay more in taxes if she’s elected.

“I’m gonna make sure that the richest among us pay their fair share in taxes. It is not right that teachers and nurses and firefighters are paying a higher tax rate than billionaires and the biggest corporations,” Harris said during a recent appearance on 60 Minutes.

Harris has also proposed expanding the child tax credit from its current threshold of $2,000 annually; she wants to provide middle-class and working-class parents with $6,000 in the first year of their child’s life, $3,600 a year when their child is between the ages one and five, and $3,000 a year after they turn six.

During a recent appearance on the “All the Smoke” podcast, Harris explained why she believes the Child Tax Credit is so important for American families and how it could support them in pursuing their dreams.

“First year — that’s such a critical stage of a child’s development, and it’s expensive,” she said. “A family’s got to buy a car seat, a crib. Most people have ambition. They have aspirations. They have dreams, and they are willing to work hard, and if we give people the opportunity to actually meet those goals, they jump for it every time.”

The vice president also wants to expand a tax deduction for costs that are incurred during a small business’ first year of operation from $5,000 to $50,000 in an effort to ease the financial burden on small business owners and incentivize more entrepreneurs to start businesses. The average owner puts $40,000 into starting their business, and Harris’ proposal would bring the deduction more in line with those costs.

Harris has also proposed reforms to capital gains taxes. For Americans who earn $1 million or more per year, the tax rate on their long-term capital gains would increase from 20% to 28%. The more than 99% of Americans who earn less than $1 million annually, however, will pay the same tax rate on long-term capital gains as they do now.

Finally, Harris has said that if elected, she’ll “fight to eliminate taxes on tips for service and hospitality workers.”

Trump’s tax and tariff proposals could hurt families

In contrast to Harris’ plans to raise taxes on the super wealthy and corporations, Trump has said that he plans to permanently extend his 2017 tax cuts, including for the wealthiest Americans and corporations.

“You’re all people that have a lot of money,” Trump told a group of donors gathered at Mar-a-Lago for a fundraising dinner for North Carolina gubernatorial candidate Mark Robinson last December. “You’re rich as hell. We’re gonna give you tax cuts.”

Trump has also said he wants to cut the corporate tax rate from 21% to as low as 15%, which conventional estimates from the Penn Wharton Budget Model (Trump’s alma mater) and the Tax Foundation indicate would reduce revenue by as much as $675 billion through fiscal year 2034, potentially adding even more to the national deficit.

The former president hasn’t explained how he’ll offset these extended tax cuts to prevent the national deficit from growing. Instead, he’s said that a new government efficiency commission headed by billionaire entrepreneur turned far-right figurehead Elon Musk will help to offset the cost of his corporate tax cuts, although he hasn’t offered specifics.

Trump has also said that his tax cuts would be paid for with “trillions of dollars” generated by things such as stronger economic growth and new tariffs (taxes on imports).

Trump has proposed a 20% tariff on all imported goods and 60% tariff on Chinese imports, which could, in theory, raise several trillion dollars over the next 10 years, but such tariffs would reduce other revenues due to their economic effects and impose a de facto tax on American households.

One area in particular where families could feel the pinch of Trump’s tariffs is the food sector. About 15% of the American food supply was imported last year, including 94% of seafood, 55% of fresh fruit, and 32% of fresh vegetables, according to the US Food and Drug Administration (FDA).

If Trump were to impose tariffs on food products, it would reduce supply, causing prices to rise, while American grocery stores — and ultimately consumers — absorb the costs.

“Importers will no doubt pass on the cost to consumers unless they have a reason to eat the cost themselves,” Stephen Craven, a former trade negotiator for the US Department of Commerce wrote in an op-ed for CNN. “As domestic suppliers are unlikely to be able to undercut them on price any time soon…consumers are likely to foot the bill.”

Morgan Stanley economists also estimate that the implementation of these tariffs would mean 70,000 fewer jobs created each month in the US.

Trump has also said that he plans to exempt Social Security and tip income from taxes. The former proposal would reduce revenue by $1.6 trillion, according to a Committee for a Responsible Federal Budget (CRFB) and the Tax Foundation. That plan, along with extending his tax cuts and further cutting corporate income taxes, would likely add $3.6 trillion to $6.6 trillion to primary US deficits over the next decade.

All told, Trump’s tax proposals would, on average, lead to a tax cut for the richest 5% of Americans and a tax increase for all other income groups, according to a new in-depth analysis by the Institute on Taxation and Economic Policy (ITEP). If these proposals are in effect in 2026, the richest 1%, or those with incomes of $914,900 per year and above, would receive an average tax cut of about $36,300.

The middle 20% of Americans, or those with incomes between $55,100 and $94,100 annually, would face an average tax increase of more than $1,500 per year. The poorest 20%, or those with incomes less than $28,600 per year, would face an average tax increase of about $800 annually.

Medical debt will no longer appear on credit reports for all Americans

This new rule will erase an estimated $49 billion in unpaid medical bills from the credit reports of roughly 15 million Americans, according to the...

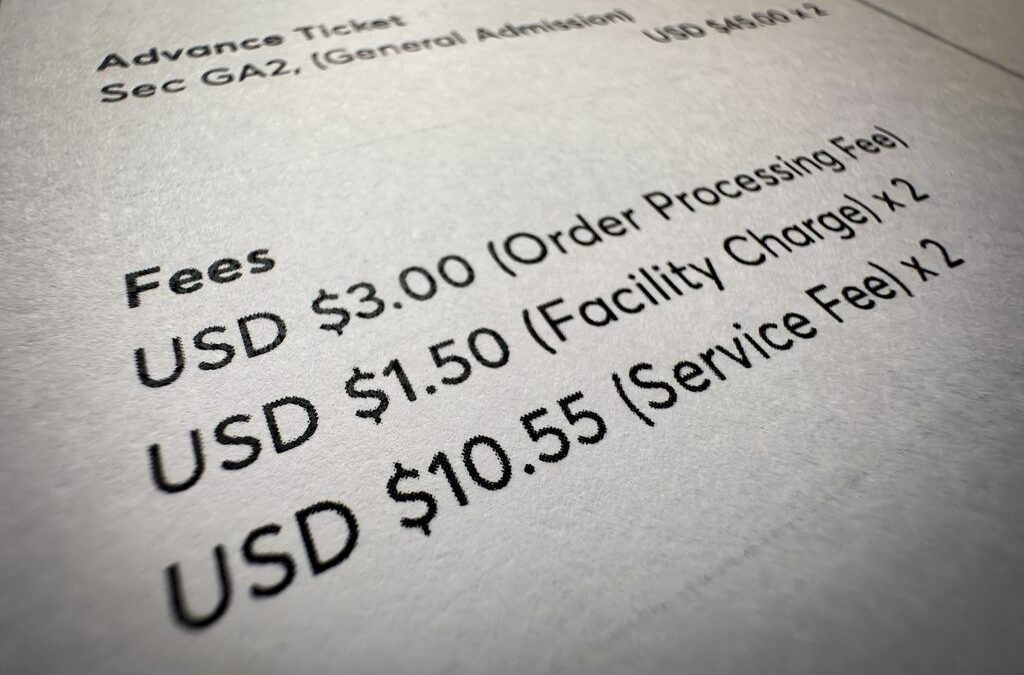

Sick of hidden fees on concert tickets and hotel stays? A new federal rule bans them.

Now, live event businesses and hotels must clearly list their prices in both their advertising and pricing information. American consumers on...

Trump’s economic plans would worsen inflation, experts say

Mainstream economists warn that Trump's plans to impose huge tariffs on imported goods, deport millions of migrant workers, and demand a voice in...

Harris wants to cap child care costs and expand the child tax credit. Trump’s solution? Tariffs.

Harris has proposed capping families’ child care costs to 7% of their income and offering families of newborns up to $6,000 in the first year of the...

Harris wants to lower grocery prices by taking on price gouging. Trump’s plan would increase prices.

Kamala Harris has said that she will call on Congress to pass a federal ban on price gouging and give the federal government more authority to...

Harris’ plans aim to make housing more affordable. Trump’s plans are less clear.

Harris has vowed to increase the available housing supply by three million homes and to provide lower-income first-time homebuyers with up to...