Photo via Getty

Right now, kids and parents across the US are sitting down with calculators, hoping they’ll be able to afford college this fall. And most of them will turn to the FAFSA for help.

If you’re one of them, you might have heard there’s a new FAFSA form (which officially launched on Dec. 31, 2023). We’re here to tell you how it works, what’s changed, and what the new timeline is.

FAFSA, which stands for “Free Application for Federal Student Aid,” is a form that helps both prospective and current students determine whether they’re eligible for financial aid. The US Dept. of Education has recently updated the FAFSA (say goodbye to about 26 questions), noting that if you’ve got all of your documents on-hand, the form should only take about 10 minutes to complete.

One major change to know about right off the bat is that the FAFSA will now be your single form for determining eligibility for federal Pell Grants and other federal and college student loans.

Deadlines for FAFSA form submissions vary depending on where you live—here’s a helpful link breaking down the deadlines for the 2024-2025 academic year by state.

For more information on what’s changed, the new timeline, who qualifies, and how to apply, keep reading.

What’s changed on the FAFSA form?

In addition to there being fewer questions on the 2024-2025 academic year FAFSA form, some information will now be taken directly from the filer’s tax return for the previous year. This feature is automatic and available to every parent/legal guardian filling out the form.

Also, some questions on the FAFSA form have been removed completely, i.e. questions regarding drug convictions, which would previously prevent someone from getting financial aid but will no longer prevent them from doing so.

One other important note: Male students no longer have to register for selective service to be eligible for financial aid.

The new timeline

The new FAFSA form is available here. You can start submitting your form ASAP.

Cutoff dates for FAFSA submissions vary by state and by school, so remember to follow this link to figure out when you need to get yours in. For example, Michigan residents need to submit their FAFSA at the very latest by May 1, 2024. However, if you’re applying to the University of Michigan, you must submit your FAFSA record with your application, which is due by March 31, 2024. Applying to Michigan State University? Your application is due by Feb. 1, 2024, and financial aid awards from the school are given on a first-come, first-served basis until funds are exhausted, based on receipt of a student’s FAFSA. (So you’d want to get your FAFSA in early there.)

Colleges will contact students directly about awards they can offer—usually with a letter or an email. Those letters are typically sent in March, and students must commit by May 1, 2024.

It’s worth noting: Award letters may come a little later this year, because colleges won’t begin receiving FAFSA data until the end of January.

What about Pell Grants?

One type of financial aid available through the FAFSA is federal Pell Grants, which “are awarded only to undergraduate students who display exceptional financial need and have not earned a bachelor’s, graduate, or professional degree,” per the Federal Student Aid website.

The amount of money you receive from a Pell Grant varies, but the maximum amount awarded for the 2023-2024 Academic Year was $7,395. Here’s a handy payment schedule from last year’s Federal Pell Grant program to give you a rough idea of how much money you may be able to expect.

More students will qualify for Pell Grants in the 2024-2025 academic year than in previous years—approximately 1.5 million more students, per CNN. The outlet noted, “Those whose family income is in the range of $40,000 to $70,000 and who have no siblings in college are expected to see an increase in their Pell grant amount.”

However, students with siblings who are also enrolled in college may lose money with these new changes. The “sibling discount” is no longer offered, meaning “the amount of financial aid a student is eligible for will no longer increase if he or she has a sibling in college at the same time,” according to CNN.

Regardless of whether siblings are involved or not, the important thing to remember with Pell Grants is that they do not have to be repaid. Student loans, however, do need to be repaid.

Pell Grant approval (typically) arrives not long after you’ve submitted your FAFSA form. Online applications speed up the process, and pell-grants.org notes that you’ll likely receive confirmation of your eligibility within three to four weeks of submitting your application.

Who qualifies for financial aid?

There’s no income cap for receiving financial aid listed on the new FAFSA form, but several factors go into determining whether a student gets federal assistance for college.

According to the Federal Student Aid website, general eligibility requirements for federal aid include that “you have financial need for need-based aid, are a US citizen or eligible noncitizen, and are enrolled in an eligible degree or certificate program at an eligible college or career/trade school.”

Other factors include:

- A valid social security number

- Being accepted to or enrolled in an eligible degree or certificate program as a student

- “Satisfactory academic progress” in either college or career school (FWIW, financial aid can be rescinded if you aren’t performing well in college)

- Consent to/approve of the transferral of your federal tax information on the 2024-25 FAFSA form

- Your signature stating that you are not currently in default on a federal student loan/don’t owe money on a federal student grant/that you’ll only use federal student loans for academic purposes

FYI: Information regarding eligibility for noncitizens, unaccompanied homeless students, students who are currently in or have been in foster care, and other specific circumstances can be found here.

Qualifying factors for FAFSA approval include “family size, whether the family is headed up by a single parent, and the family’s adjusted gross income and how it compares with the federal poverty guideline.”

Note: Parents’ citizenship status will not be taken into account when determining eligibility, but undocumented students remain ineligible for financial aid through FAFSA.

Additionally, financial gifts from grandparents (or other family members) won’t decrease eligibility like they did in the past. Per CNN, “If the gift is not on the federal tax return, it won’t have an impact on the student’s aid eligibility any longer.”

Use this FAFSA student aid estimator to give yourself an idea of what you may qualify for if/when your application is approved.

How do I apply/submit the FAFSA form?

Prospective/current students are responsible for filling out the FAFSA form. If the student is still a dependent, parents/guardians can assist them.

However, parents and students must each create their own account with Federal Student Aid (FSA) and receive an FSA ID prior to starting the application process. To create your FSA ID, go here.

FYI: People without social security numbers will now be able to create an FSA ID—they were previously unable to do so.

After you create FSA IDs, the next thing you need is the new FAFSA form, which can be found here.

From there, you’ll follow the step-by-step instructions on the form.

Ron Lieber, a reporter for The New York Times, recently took to Threads to outline his application experience, which you can check out here if you want a rough idea of what to expect.

And that’s it! Once you submit your application, the next step is to sit back and wait to hear about whether you’ve been approved. Just kidding. You should start looking for scholarships—they’ll also need a copy of your FAFSA record.

The Federal Student Aid website notes that “Colleges have access to your information one day after it is processed, but each college has its own process and timeframes for accessing FAFSA information.” For many scholarships, however, you’ll need to submit your FAFSA record manually.

If you’re a student applying to college for fall 2024, stop reading this—and go get busy on your FAFSA.

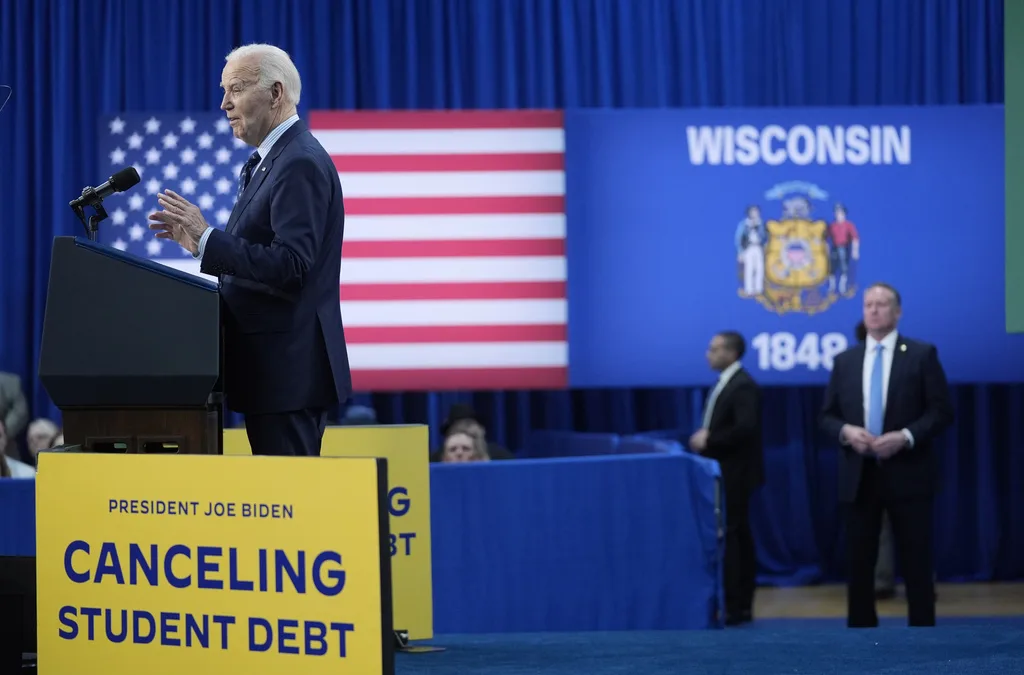

Biden unveils new plan for student debt relief

The Biden-Harris Administration on Monday unveiled new plans to relieve student debt for more than 30 million borrowers. During appearances across...

78,000 public service workers get student loans canceled by Biden administration

Through improvements to the public service Loan Forgiveness Program, the Biden administration has canceled loans for more than 871,000 public...

Biden proposes new student debt relief plan for Virginia borrowers facing ‘hardship’

The Biden administration on Thursday announced its latest proposal for widespread student loan cancellation that could provide relief to millions...

Bills banning legacy admissions at VA’s public universities clear both chambers

Companion bills banning the practice of “legacy admissions” at Virginia’s public colleges and universities are on track to become law after the...

Virginians get relief as Biden cancels nearly $5 billion more in student debt

The Biden administration on Wednesday announced that it approved the cancellation of nearly $5 billion in additional federal student loan debt for...

P&HCC’s Thanksgiving tradition embraces students worldwide

For many students, Thanksgiving week is a special time to spend with family and friends over large, festive meals. But for international students, a...