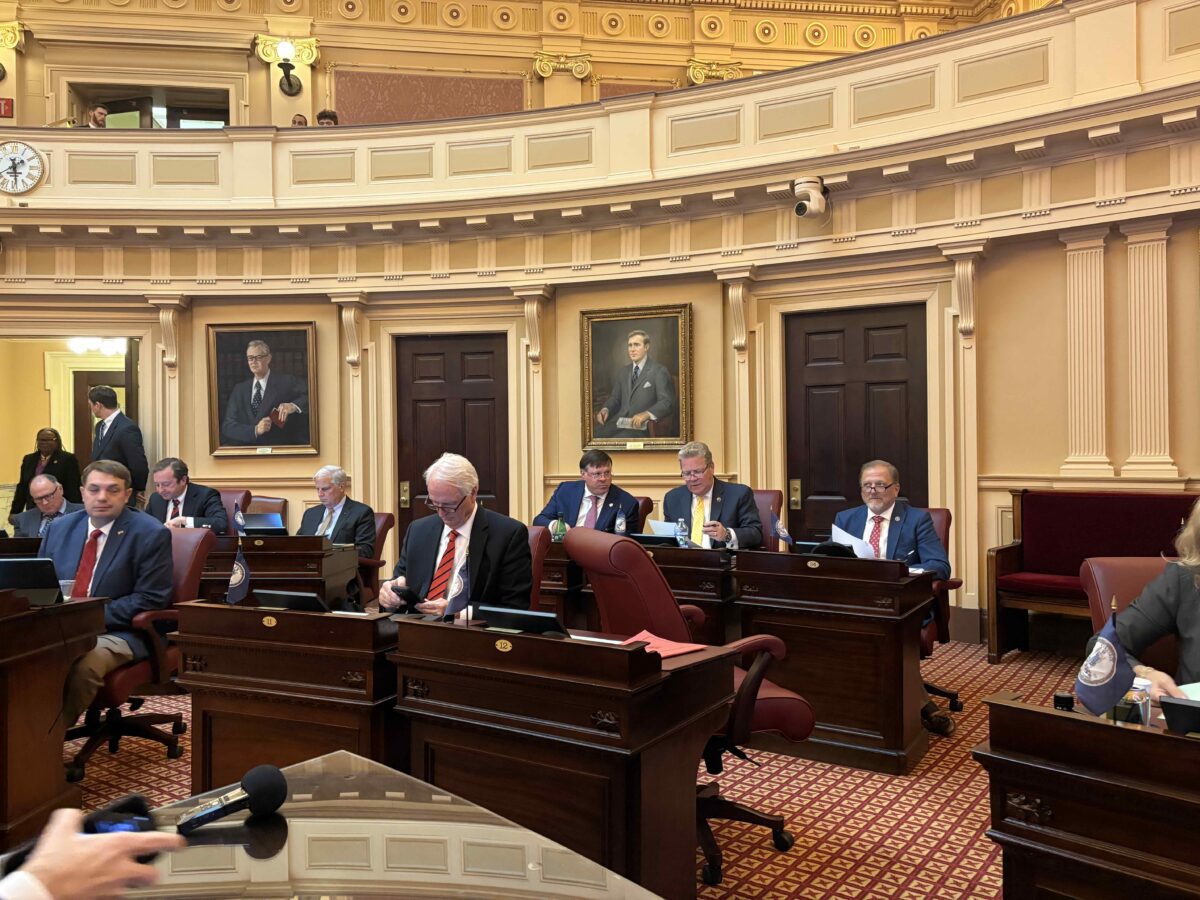

Members of the Virginia General Assembly inside the Senate chambers in Richmond on October 27, 2025. (Michael O'Connor/Dogwood)

The income of a public school teacher in Virginia is currently taxed at the same rate as the income of millionaire business executives. A new report makes the case for why that needs to change.

The Trump administration’s slashing of federal support for state health and food assistance programs is forcing Virginia lawmakers to figure out how to make up for the funding gaps as demand for social services rises.

A new report from The Commonwealth Institute of Fiscal Analysis (TCI), a nonpartisan Virginia research and advocacy organization, proposes several ideas for how lawmakers could raise more tax revenue to address the expected shortfalls while also making the state’s tax code more fair.

“We know that lawmakers going into this legislative session are gonna be facing significant revenue pressures,” said Megan Davis, a senior policy analyst at TCI and lead author of the report.

The big tax and spending bill enacted by President Donald Trump earlier this year is expected to translate into lost federal funding for Medicaid and the Supplemental Nutrition Assistance Program (SNAP). Changes to how SNAP is funded could mean that Virginia will have to pay $270 million a year to keep the program funded in the state, according to an August news release from Gov. Glenn Youngkin.

Virginia will also need to provide a $3.2 billion increase in state funding for Medicaid over three years and another $964 million for K-12 public education, according to a Richmond Times-Dispatch report on state forecasts released earlier this month.

Among the ideas included in TCI’s report is the creation of a 10% tax on income over $1 million that would raise an estimated $1.4 billion in fiscal year 2027.

Currently, Virginia’s highest income tax rate is for people making more than $17,001—so most Virginia taxpayers—whose income is taxed at 5.75%. That means the income of the average teacher in Virginia making $70,441 in 2024 is taxed at the same rate as the income of, say, Robert Blue, the CEO of Dominion whose base salary was $1.2 million last year.

“The majority of people filing taxes in Virginia do have income in that top income tax bracket, and we’re saying it’s time for a change,” Davis said, noting that Virginia’s income tax brackets have not changed since 1990.

State Del. Phil Hernandez (D-Norfolk) filed legislation in the General Assembly’s last regular session to enact a 10% tax on millionaires, but it died in committee. Hernandez could not be reached for comment. Given revenue is a hot topic heading into the upcoming session, a similar bill could come up again.

“We have hope at least that it’s going to remain part of the conversation as we figure out how to pay for the bills that the state’s going to have to pay and also be able to make investments at a moment when communities really need them,” Davis said in an interview.

Another, more novel idea proposed by TCI is inspired by Minnesota’s recent adoption of a tax on passive income. TCI proposes establishing a similar wealth tax of at least 1% on individuals making $200,000 and couples filing jointly who earn at least $250,000. Doing so could net Virginia’s coffers $258.5 million or more a year, TCI estimates.

The federal government already taxes this kind of income earned from things like stock trades at a rate of 3.8% on high-income households. The federal tax was enacted in 2013 to help with the cost of expanding access to health care and make the tax code more fair, according to the Institute on Taxation and Economic Policy (ITEP). TCI’s proposal seeks to piggyback on top of this federal tax.

“There is growing awareness, and frustration among many, that current federal and state tax laws are not well suited to taxing wealthy families in a way that genuinely reflects their ability to pay,” according to ITEP.

Another way Virginia could raise more revenue that saw a lot of debate last session would be to add a tax on digital services—like software, downloaded music, and e-books—for consumers and businesses. Doing so could raise over a billion dollars in fiscal 2027, TCI estimates.

Davis said Virginia has made incremental progress in recent years to address what she called the “upside down structure of our tax code.” She hopes that as lawmakers look to raise revenue, they do not rely on funding cuts to programs already operating on shoe-string budgets. Such cuts historically disproportionately hurt Black, Hispanic, and low-income communities, Davis said.

“We know the money is out there because we’ve been giving it away,” Davis said in reference to Trump’s massive tax cuts for the wealthy. “The wealthy are getting wealthier, and we know the funds exist.”

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Virginians and our future.

Since day one, our goal here at Dogwood has always been to empower people across the commonwealth with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Virginia families—they will be inspired to become civically engaged.

Virginia campus workers rally to end union restrictions rooted in Jim Crow

Former Gov. Glenn Youngkin last year blocked legislation that would give collective bargaining rights to public sector workers. Now, some of those...

$15 minimum wage inches closer to becoming law in Virginia

A bill to raise the state minimum wage to $15 passed out of the House of Delegates Labor and Commerce Committee on Tuesday. One of Virginia...

These Virginia Democrats want to make the wealthy pay their fair share

One proposal would establish a millionaire’s tax and another would impose a corporate welfare tax on large employers with workers who depend on...

Virginia Senate Dems roll out ‘2026 affordability agenda’

Virginia Senate Democrats held a press conference on Tuesday laying out their legislative priorities for this year’s General Assembly session. On...

Virginia Democrats back bills to address gender, racial pay disparities

Forthcoming legislation aims to bring greater transparency in the hiring process and combat wage discrimination in Virginia. Two Democratic state...

Youngkin touts strength of Virginia economy despite warning signs

Gov. Glenn Youngkin shared a rosy view of Virginia’s economy that state Democrats strongly disagreed with. Republican Gov. Glenn Youngkin offered a...