Now, each chamber will take up the other’s budget and reject it so that the bills will go to a conference committee—a small group of lawmakers tasked with hashing out a compromise spending plan that will be sent to Youngkin’s desk for signature. (AP Photo/Steve Helber)

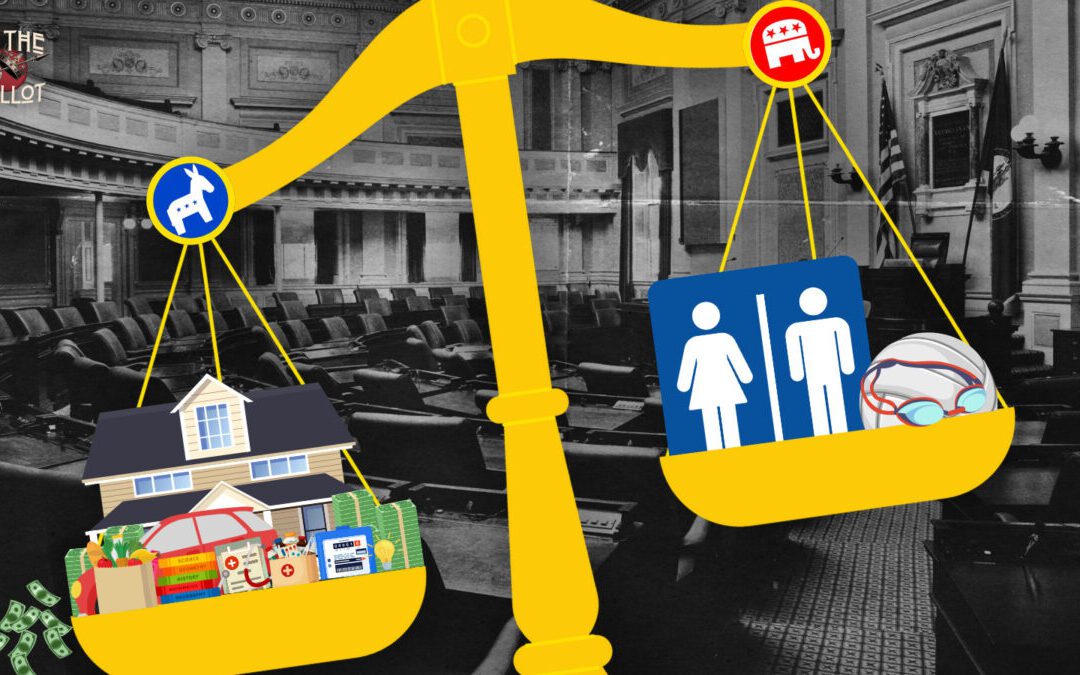

Virginia’s Democratic-controlled Senate and House of Delegates have both passed their own proposed versions of the next two-year state budget, documents which both diverge from Gov. Glenn Youngkin’s vision by ditching all but one component of his proposed tax policy changes.

In December, both chambers approved amendments to the 2024-2026 budget. They both opted to keep Youngkin’s idea of expanding the sales tax to apply to digital services, such as streaming services. Both chambers dissented from Youngkin’s ideas regarding Virginia’s income tax rate and sales tax, however.

Late last year, Youngkin announced he was pushing for a cut to the income tax rate, something he claimed would draw more people, and therefore jobs, to the commonwealth. He proposed increasing the sales tax rate and adding the tax on digital services to offset that revenue reduction.

Democratic lawmakers and liberal advocacy groups criticized these plans, arguing they were a handout to the wealthy. According to data from the Institute on Taxation and Economic Policy (ITEP), families in the bottom 20% of incomes, or those making below $30,000 annually, would see an average tax increase of $44 under Youngkin’s proposed tax plan. Meanwhile, those in the top 1%, or those making over $763,000 annually, would see an average tax cut of over $9,640.

Democratic Sen. L. Louise Lucas (D-Portsmouth), who chairs her chamber’s Finance and Appropriations Committee, said during a hearing on Feb. 18 that Youngkin’s proposal was “not sustainable,” especially in light of concerns raised regarding the current funding formula for public schools.

Instead, the legislature has proposed using tax revenues to boost spending on public education, including a push to raise pay for Virginia teachers, whose pay hasn’t topped the national average in over 50 years.

Rejoining the Regional Greenhouse Gas Initiative

The House budget also contains language directing the state to rejoin the Regional Greenhouse Gas Initiative (RGGI).

The RGGI is a multi-state effort in the eastern United States to “use a market mechanism to reduce power plant emissions with the goal of slowing climate change.”

The states in the initiative are working to transition to renewable sources of energy, like solar and wind, but to ease the transition, utilities in the member states—and outside investors—“can purchase an ever-shrinking number of carbon allowances at quarterly auctions,” during the years-long process, as NPR reported.

The RGGI is the first cap-and-invest initiative implemented in the United States.

The effort has been lauded by environmentalists in Virginia, who say that the benefits of the RGGI are vast. According to them, reducing greenhouse gas emissions in the state is “the best way” to fight against the “carbon-driven climate crisis” while also “reducing the prominence of harmful air pollutants associated with burning fossil fuels.”

In June, Virginia regulators advanced Youngkin’s plan to withdraw from the RGGI, a move that’s now being challenged in court by a coalition of environmental groups.

Now, each chamber will take up the other’s budget and reject it so that the bills will go to a conference committee—a small group of lawmakers tasked with hashing out a compromise spending plan that will be sent to Youngkin’s desk for signature.

Virginia Senate Dems advance constitutional amendments

The amendments to redraw the state’s congressional map, protect reproductive rights and gay marriage, and restore voting rights for the formerly...

Virginia House Democrats advance four constitutional amendments

The Virginia House of Delegates advanced four constitutional amendments dealing with abortion rights, gay marriage, voting rights, and...

Spanberger, Dem leaders release ‘Affordable Virginia Agenda’

Gov.-elect Abigail Spanberger released a list of bills and proposals she supports to lower the cost of health care, energy, and housing in Virginia....

Progressive Dem eyes Virginia congressional bid amid possible redistricting

State Del. Sam Rasoul of Roanoke says he supports Medicare for All, a Green New Deal, and an end to US military support for Israel. In the wake of...

Commentary: The costs of being in the majority

Democrats won on issues of affordability and working-class concerns. Now it’s time to deliver. Governor-elect Abigail Spanberger and Virginia...

Meta’s ‘teen safety’ tools are failing Virginia kids—and Gov. Glenn Youngkin isn’t helping

Parents and cybersecurity experts want Virginia lawmakers to hold companies like Meta accountable when their platforms fail to keep their pledges to...